Massive post-graduation debt poses risk for Rutgers seniors

The average student in the Rutgers University-New Brunswick class of 2012 owed $26,656 worth of debt in student loans, according to the nonprofit organization Project on Student Debt’s website.

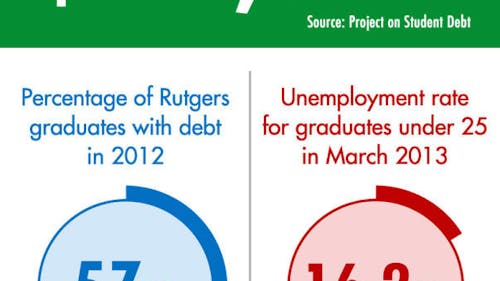

Of Rutgers graduates, 57 percent owed money on their education.

New Jersey ranks eighth in the nation for student loan debt, according to the website. Rutgers-New Brunswick ranks 14th in the state for most debt.

Yet the job prospects for alumni hoping to pay off their debt are disheartening. According to a report from the Economic Policy Institute, the unemployment rate for graduates under 25 was 16.2 percent in March 2013, more than double the national average.

Ben Lin, a Rutgers graduate from the School of Environmental and Biological Sciences, is familiar with the dilemma. He planned to score a well-paying corporate job to begin paying off his debt.

But he now realizes the difficulties of that route. Instead, he is probably going to take two jobs and work hard to get out of the obligations “as fast as [he] can.”

“It’s kind of a heavy burden that you don’t realize until you graduate,” he said.

He also plans to stay at his parents’ or grandparents’ house rather than pay an extra $400 per month for rent and is carefully looking at his income and spending to be able to make regular debt payments.

Joe Cashin, student representative on the Board of Governors, is temporarily relieved of his undergraduate debt. He is going to study at the Graduate School of Education in the fall.

When Cashin, a School of Arts and Sciences senior, graduates, he will owe $30,000 on his degree as he pursues his dream job of teaching high school English.

It is a “sad state of affairs” that students go into debt to get an undergraduate education, especially since many employers expect a master’s degree, he said.

He disputed claims that students can get through college by working or could go to community college first.

“Why should it be the case that you might have to take six years to get a bachelor’s degree?” he said.

Graduates can look at different methods to relieve the pain of debt pressure.

John Moetz, manager of Billing and Collections at Rutgers, said they have the option of paying off their debt early and avoiding interest.

Enrolled students have three main options for receiving loans: the Federal Perkins Loan Program, Direct Subsidized Loans and Direct Unsubsidized Loans. Each comes with its own interest rates and payment rates.

Graduates can apply for payment deferment if they are part of a graduate fellowship program, if they are going through a period of unemployment or can prove economic hardship and if they are in active military service.

They can also register for income-contingent repayment, which allows them to set their payments based on their current income, Moetz said.

“They’re not appropriate for everybody, but there are many options available,” he said.

He encouraged students to contact the student loan office with questions.

Some graduates have resorted to unconventional options for funding college and paying off loans. Besides military aid, the federal agency Corporation for National and Community Service offers to pay off loan debt in exchange for community service work.

The Segal AmeriCorps Education Award, given to volunteers who have completed a full year of service, allows loan forgiveness at secondary education institutions, according to the AmeriCorps website.

Since the founding of AmeriCorps in 1994, more than 800,000 members have earned more than $2.4 billion in education awards, according to the website.

More recently, SponsorChange.org has offered to pay student loan debt in exchange for working at nonprofits across the country. The organization asks for sponsors to fund loan payments while recent graduates work for free.

Such methods may become more relevant as college costs go up.

Nick Jermer, state board chair for Rutgers’ chapter of New Jersey Public Interest Research Group, said 7.4 million college graduates would see their college costs go up by an average of $1,000.

Along with the Consumer Financial Protection Bureau, NJPIRG aims to create more accountability for private lenders such as Sallie Mae, which has the highest number of complaints in the state.

“We’re lucky to have the CFPB because thousands of students can look at its public complaint database [of lenders],” Jermer said. “It all goes to show how powerful students can be.”